A person’s integrity says a lot about their character. So it is not surprising that someone willing to bend facts and share half-truths and lies when creating the CES Letter would show the same lack of care in their business dealings. The public record of Jeremy Runnells’ nonprofit and for-profit businesses raises serious questions about not only the ethics but also the legality of his testimony-shattering business ventures.

The Creation of the CES Letter Foundation

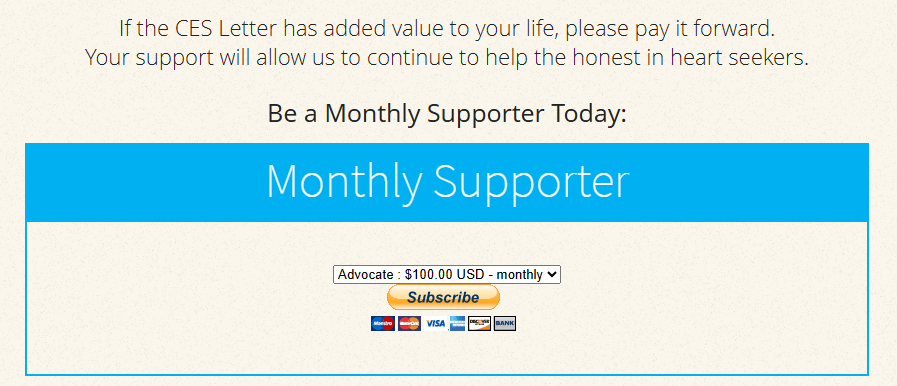

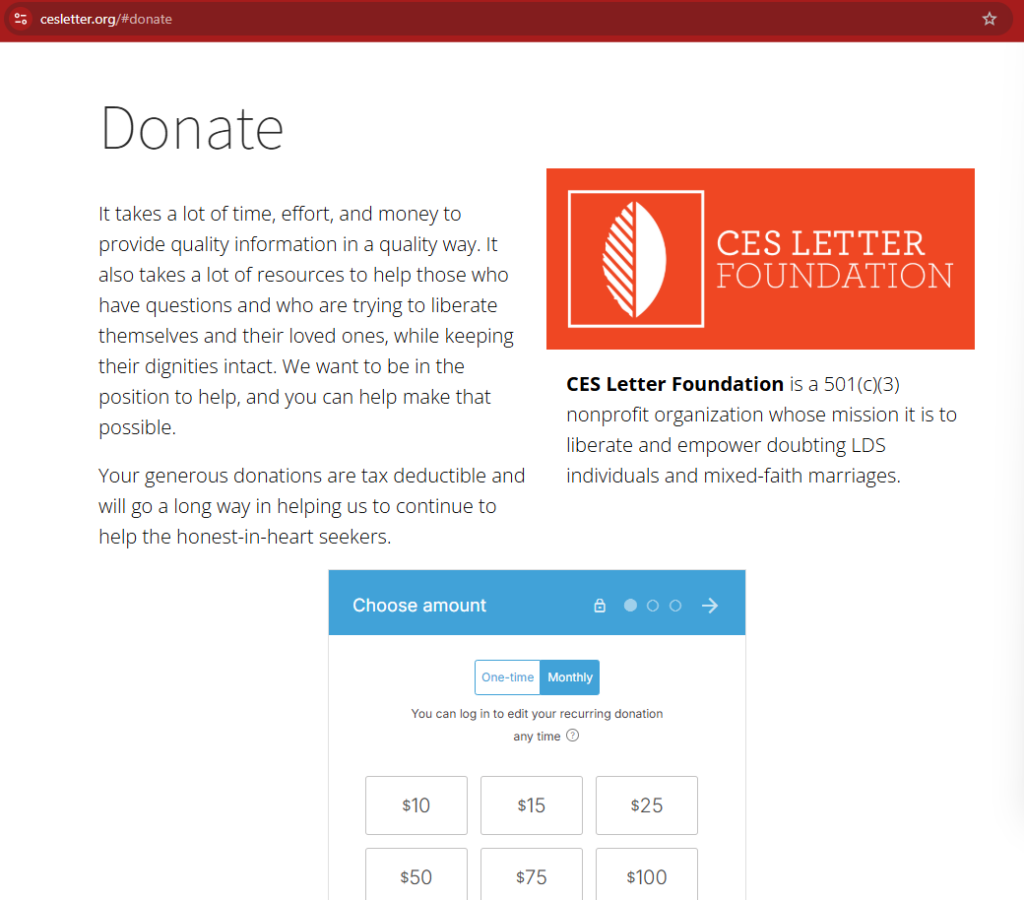

The CES letters website was first published on the website CESLetter.com in 2013. By August of 2013, Jeremy began monetizing the website by accepting “donations.”

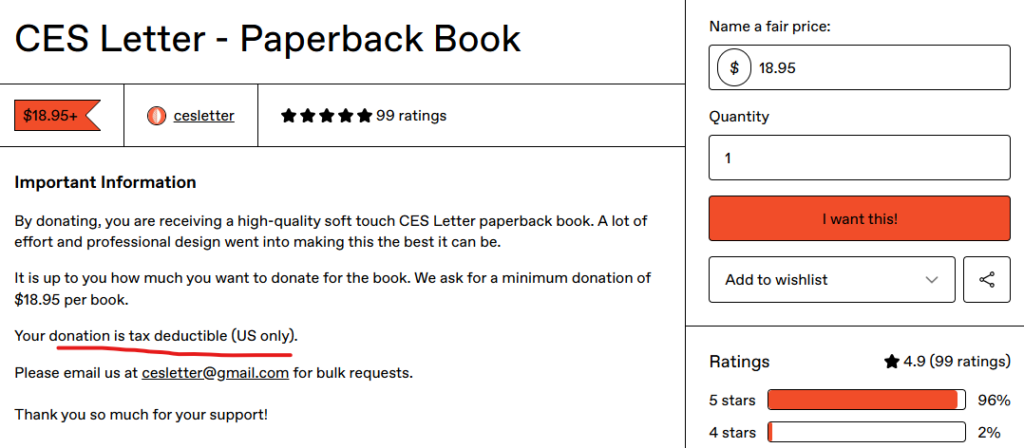

He also started selling copies of a paperback version of his book. As the donations started adding up, he decided that it was time to officially make a business out of destroying faith.

A Nonprofit With Two Different Identities

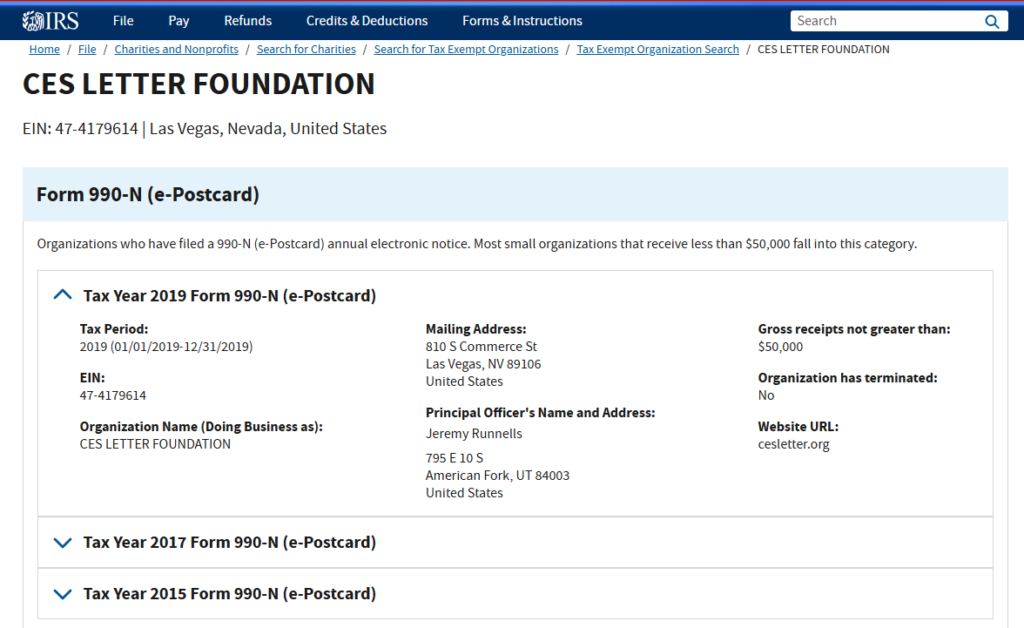

The CES Letter Foundation was officially formed in Nevada on June 1, 2015. About the same time he switched his primary webside domain to CESLetter.org to make it more “official” and easier to accept donations as a non profit corporation.

State records list the business address as 810 S Commerce Street in Las Vegas, which is a gambling supply store.

IRS records, list Runnells’ home in American Fork, Utah as the principal office. A nonprofit using a gambling retail storefront for one filing and a private residence for another is unusual.

Why File the CES Letters Foundation in Nevada?

There are practical reasons why someone might choose Nevada, especially if they have things they want to hide. Nevada is known for having some of the loosest nonprofit reporting requirements in the country. Nevada does not require charities to publicly disclose their financials, revenue, donations received, or how those donations are spent. It also does not maintain the kind of searchable, transparent charitable-organization that other states do. Nevada gives nonprofits a much lower level of oversight and far fewer public-disclosure obligations.

Filing in Nevada allowed him to avoid disclosing donation amounts, officer compensation, or financial activity of any kind. In Nevada a lack of transparency would not raise flags.

Following a Business Model Already Established

The infamous anti-Mormon podcaster John Dehlin accepts “non profit” donations on his website Mormon Stories and collects more than a million dollars a year including a personal salary for himself of a quarter million.

Because Dehlin’s financial record is public, Runnells doesn’t want to be subject from the same hypocricy accusations as Dehlin, and can avoid that by splitting his operations across multiple states and corporations and by keeping his filings minimal or nonexistent. Runnells is doing the “smart thing” by hiding the evidence so that his donors aren’t able to see how much his faith-destroying business financially profits him.

CES Letter Foundation Fails to Complete Minimal IRS Filings

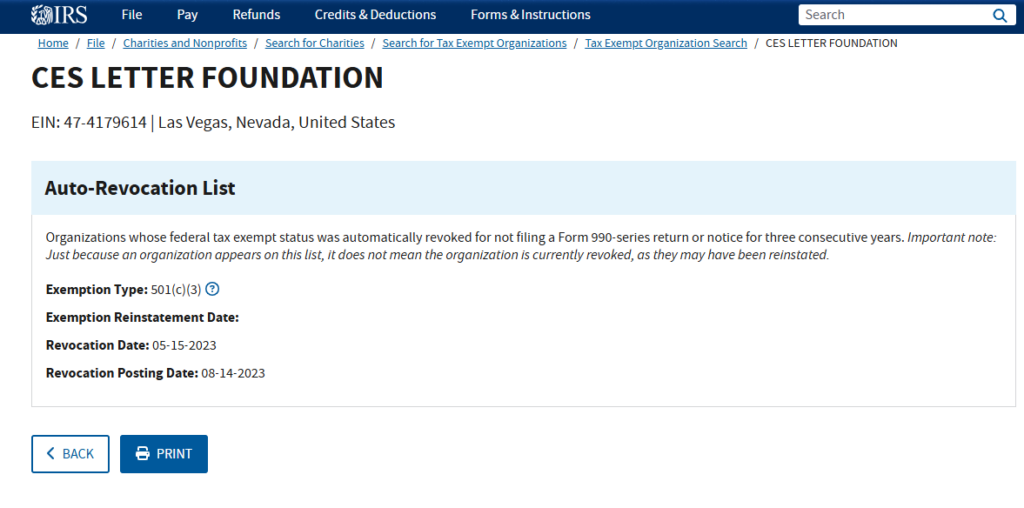

From 2015 to 2019, the CES Letter foundation filed only three returns, all Form 990-N e-postcards. A 990-N tells the public nothing except that an organization claims less than $50,000 a year in revenue. There are no financial statements, no expense disclosures, and no record of how donations were spent. After 2019, the filings stop.

Both Nevada and the IRS eventually revoked the organization—Nevada for missing required annual reports, and the IRS for missing three consecutive tax years.

The Nonprofit Continued Accepting Donations After Losing Status

Despite the revoked status, CESLetter.org continues to advertise the foundation as a 501(c)(3) and continued encouraging tax-deductible donations. Anyone familiar with nonprofit rules knows that once the IRS revokes an organization, contributions are no longer deductible. That gap between what donors were told and what the IRS shows raises obvious questions about care, accuracy, and honesty.

Dishonest and Illegal

When a non profit organization continues to advertise themselves as a 501(c)(3) nonprofit after losing that status, they are not just being misleading, they are also violating federal and state rules that govern charitable solicitation. The CES Letter Foundation stopped filing required IRS forms after 2019 and formally lost its nonprofit status in 2023. Presenting a revoked organization as a nonprofit is illegal under IRS regulations, FTC charitable-solicitation rules, and Nevada state law.

Donors Also at Risk

There is another consequence that donors won’t realize. Anyone who has contributed to the CES Letter Foundation during the years it was not recognized as a nonprofit, and claimed those contributions as tax deductions, may have a tax liability. The IRS can disallow those deductions and impose penalties and require repayment. Runnells’ failure to maintain his filings and keep promoting the foundation as a charity potentially put his donors at personal financial risk.

The For-Profit Corporation: ManaFAQ, Inc.

Formed in Delaware, Registered in Utah

In February 2017, Runnells formed a for-profit Delaware corporation called ManaFAQ, Inc.

Why would he, operating a business in Utah choose to establish it in Delaware?

The same reason he set up the CES Letters Foundation Corporation in Nevada— but he probably didn’t want to have two shady businesses that were essentially the same thing, in the same state. Delawares business laws allow companies operate without revealing much to the public. Delaware is known for offering the lowest amount of public visibility into corporate ownership and finances.

From a logical perspective of running businesses, choosing two different states makes little sense. For my buisness I have employees in multiple states and get overwhelmed by the nuisance of having to figure out the tax filings for each of them. It would be far easier to learn one state’s filing and reporting system, pay one state’s fees, and maintain one state’s filings.

But if someone wanted to create layers of separation—one nonprofit with zero public financials, and one for-profit shielded behind Delaware’s anonymous corporate structure—then splitting them across different states would be an intentional tactic. Delaware, in particular, is widely used when someone does not want to reveal owners, assets, revenue, or internal financial activity. So if the intention were to make the paper trail as difficult as possible to follow, using Nevada for the nonprofit and Delaware for the for-profit makes perfect sense.

Two months later, Runnells registered ManaFAQ as a “foreign entity” in Utah, listing his home address, likely so he could legally operate it there.

Dissolved and Dropped

Utah dissolved ManaFAQ in 2018 for failure to renew. Delaware listings show the company later lost good standing because it failed to maintain a registered agent. For a business that was supposed to be active, the filings show a short life and little interest in long-term compliance.

Doubtsy: The Business of Creating Doubters

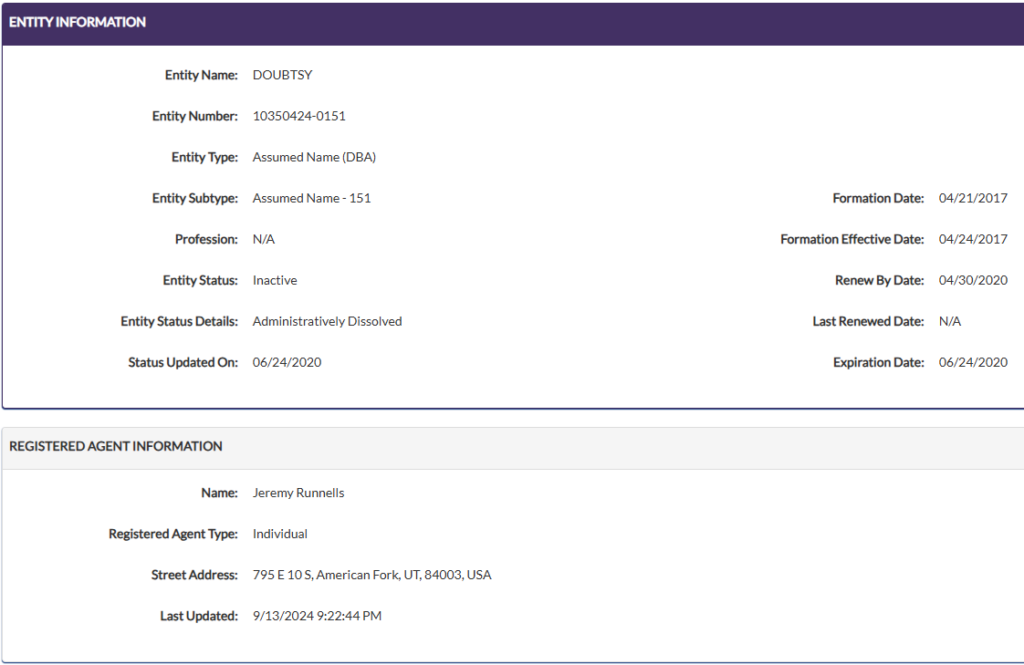

A DBA Created to Operate ManaFAQ

After registering ManaFAQ, Runnells created Doubtsy—a DBA owned by ManaFAQ and registered at the same American Fork address.

Surviving descriptions of the website explain that Doubtsy offered services for those trying to build a brand off of creating doubt. Trying to help ex-mormons to publish books and then sell them on his website.

Trying to publish your own book? Looking to sell products to inspire or help your fellow doubters? Or just want to hire a talented…

Essentially, it appears that Runnell was trying to create his own “coaching program” for other aspiring entrepreneurs looking to cash in and earn from producing Anti-Mormon materials. When the CES Letter was originally released, Runnells encouraged people to take the content he provided, put it in their own name, and use it as their own. Perhaps Letter For My Wife was one of his Doubtsy success stories?

Fortunally, the Doubt creating business didn’t seem to be very successful, or Runnells decided he didn’t want to cannablize his own faith destroying enterprise by creating competition as it was becoming very profitable for him.

A Longer Life Than Its Parent

What is unusual is that Doubtsy stayed active on the State of Utah registry until 2020—two years after the parent company ManaFAQ dissolved. The DBA outlived the corporation that legally owned it, another example of loose management and inconsistent business care.

Structural Overlaps That Raise Questions

Shared Address

Runnells’ American Fork Address (likely his home) served as the address for:

- the CES Letter Foundation (in IRS filings)

- ManaFAQ, Inc.

- Doubtsy

This creates a situation where nonprofit and for-profit activities overlap physically and operationally.

Lack of Non-Profit Transparency

There is no public record of how donations were handled. Because the CES Letter Foundation filed only postcard returns, nothing is available to confirm whether funds were used appropriately, whether compensation existed, or whether any money moved between projects.

I was unable to find any evidence myself, but according to Jim Bennett’s break down of the CES letter, in 2016 Runnells made more than $10,000 per month from his CES Letter business. And if it made $10,000 per month a decade ago, how much is he profiting now, and why is it not being legally reported to the IRS?

2024 Attempt to Trademark “CES Letter”

In 2024, Jeremy Runnells filed federal trademark application 98719974 for the name “CES Letter”. This happened after his nonprofit had already been revoked by the IRS in 2023 for failing to file its required tax forms. Since the filing, the USPTO has pushed back on the application and has not approved it. The office has raised questions about whether the name can be trademarked and whether Runnells has the right kind of commercial use to claim it.

Why he is doing this reveals his character, intent, and financial motive behind the CES Letter. It may also be a response to actions taken by the Study and Faith Organization, which originally called itself CES Letters and used the CESLetters.org website URL.

A trademark is something people use to control a brand so they can decide who can use it, sell it, or make money from it. It is not something a person files if they are running a nonprofit “truth project.” Trying to lock down the CES Letter brand name is what you do to protect a business interest not something you would do for an actual charity.

The USPTO may be denying the CES Foundation trademark because the CES Letter has been freely shared online for a decade, and Runnells own claim is that it was just a list of questions he had looking for truth. It probably doesn’t help that he literally told people to alter the words and story to share and claim it as their own (which is exactly what Letter For My Wife does).

The biggest issue is what this filing says about his intentions. If the CES Letter is supposed to be a free document meant to “help people discover the truth,” then trying to turn it into a protected brand does not make any sense.

Conclusion

When you look at the full timeline—multiple businesses formed and dissolved, inconsistent addresses, revoked nonprofit status, continued fundraising under outdated claims, and almost no financial transparency—it becomes very hard to view the CES Letter Foundation as a well-run or honest nonprofit effort.

Nothing in this record proves criminal intent, but the filings (and lack of) speak for themselves. They show a pattern of poor compliance, questionable structure, and a lack of accountability.

Are you going to trust a the man who runs shady businesses like these with the foundation of your faith?

More resources:

AnsweringLDSCritics.com does a good job explaining the deception of the CES Letter Foundation as well as the business model of LDS critics and why they are so motivated to try and damage faith.

Continue reading at the original source →